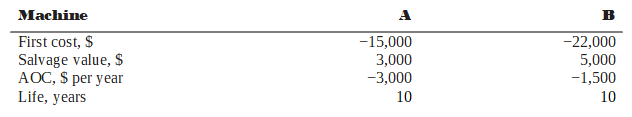

Select A or B under the following conditions using the method described or as instructed:

(a) Before-tax PW analysis using spreadsheet functions.

(b) After-tax PW analysis using classical SL depreciation over the 10-year life using hand solution.

(c) After-tax PW analysis using MACRS depreciation with a 5-year recovery period using a spreadsheet. Assume the machines will be retained for 10 years, then sold at the estimated salvage values.

(a) Function for PWA: = -PV(14%,10,-3000,3000) – 15000 displays PWA = $-29,839

Function for PWB: = -PV(14%,10,-1500,5000) – 22000 displays PWA = $-28,475

Select B with a slightly higher PW value.

(b) All AOC estimates generate tax savings; GI estimates are equal.

Machine A

Annual depreciation = (15,000 – 3,000)/10 = $1200

Tax savings = (AOC + D)(0.5) = 4200(0.5) = $2100

CFAT = -3000 + 2100 = $-900

PWA = -15,000 – 900(P/A,7%,10) + 3000(P/F,7%,10)

= -15,000 – 900(7.0236) + 3000(0.5083)

= $-19,796

Machine B

Annual depreciation = (22,000 – 5000)/10 = $1700

Tax savings = (1500 + 1700)(0.50) = $1600

CFAT = –1500 + 1600 = $100

PWB = –22,000 + 100(P/A,7%,10) + 5000(P/F,7%,10)

= –22,000 + 100(7.0236) + 5000(0.5083)

= $–18,756

Again, select B with a slightly higher PW value.

(c) Again, select machine B. All methods give the same conclusion

%20figure%203.png)

By hand, if needed:

MACRS with n = 5 and a DR in year 10, which is a tax, not a tax savings.

Tax savings = (AOC + D)(0.5), years 1-6

CFAT = -AOC + tax savings, years 1-10.

%20figure%203.png)

%20FIGURE%204.png)

%20ANSWER.png)